First-in-class drugs are often seen as commercially more attractive as they may tap into a previously underserved market segment – a lower number of therapeutic options correlates with higher prices. Many first-in-class medicines are specialty or orphan drugs meaning manufacturers have to recoup development costs from a smaller market, but a big commercial advantage is having a period of exclusivity free of competition from similar drugs.

Creating a forecast for a first-in-class product is often seen as more challenging, however by following some simple, logical steps it really shouldn’t be any more challenging than forecasting a new product into an existing class. The first and most important step is to define your model structure based on the potential source of business.

Establish the potential market size

When forecasting a first-in-class product the forecaster needs to establish where they can potentially capture patients from, this will represent the overall potential market size. This step is consistent with any other forecast and establishes a ceiling of opportunity for the new product which it can’t exceed.

The approach to establishing the market size should be no different for any other forecast and is achieved by answering the question: What patient can potentially receive your new drug? This could be either from the existing treated patient pool or from a pool of currently untreated patients. If a new product will take most of its share from a competitor or set of competitors, their sales represent a ceiling for peak share. If your new product captures currently untreated patients, the total number of diagnosed patients represents that ceiling.

How you then model the uptake of your new product will be handled in your event section but the important step in sizing the market is to have a clear understanding of the total patient population that is relevant for your forecast.

Create your baseline forecast

When the potential market size/opportunity has been established, the next step is to then identify the key products/classes that make up that market. We would advise keeping this as simple and focussed as possible, and only splitting out those products/classes that are either:

a) A key player in the therapy area

b) A direct competitor

You can then input your historical market shares for these key products/classes and then trend this out into the future to create a baseline from which your new first-in-class product can potentially, depending on the market dynamic, capture its share.

Launching your first-in-class product

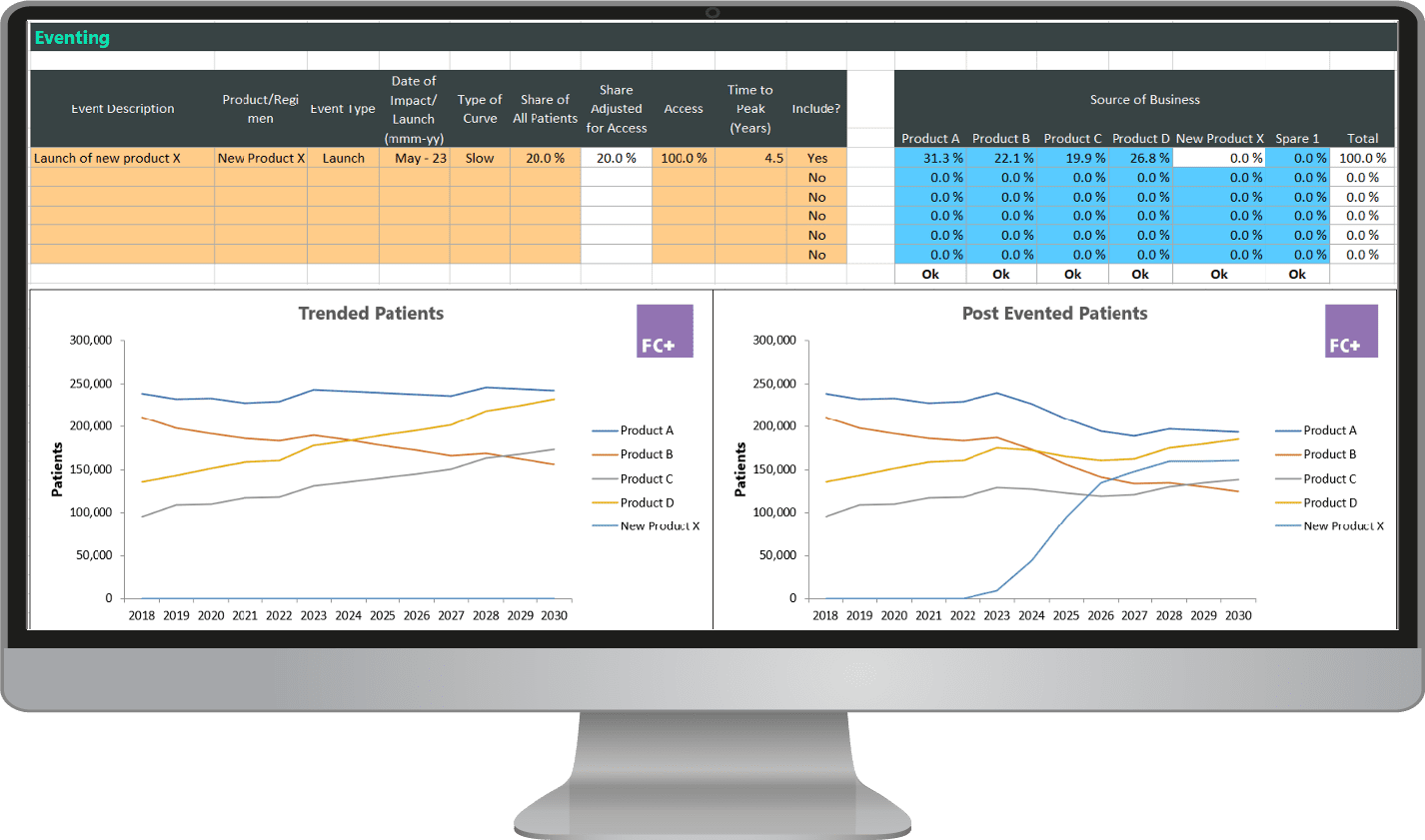

The final step is to enter standard product launch assumptions, for example, peak share, time to peak, uptake curve and source of business for the new product. Note that the source of business is an extremely valuable tool to help you model the specific market dynamic that you are facing.

Typically, the source of business can fall into three ‘types’:

Switch dynamic

The new product will take patients from existing products in other classes. If this is the case, it will be important to focus on currently treated patients in your market sizing section and then split out in your trending those competitors from which you will be taking market share.

In the screen shot below, the post evented patients are simply a ‘readjustment’ of patients from before the new product launches (with the scale of impact on each inline product being controlled by the source of business).

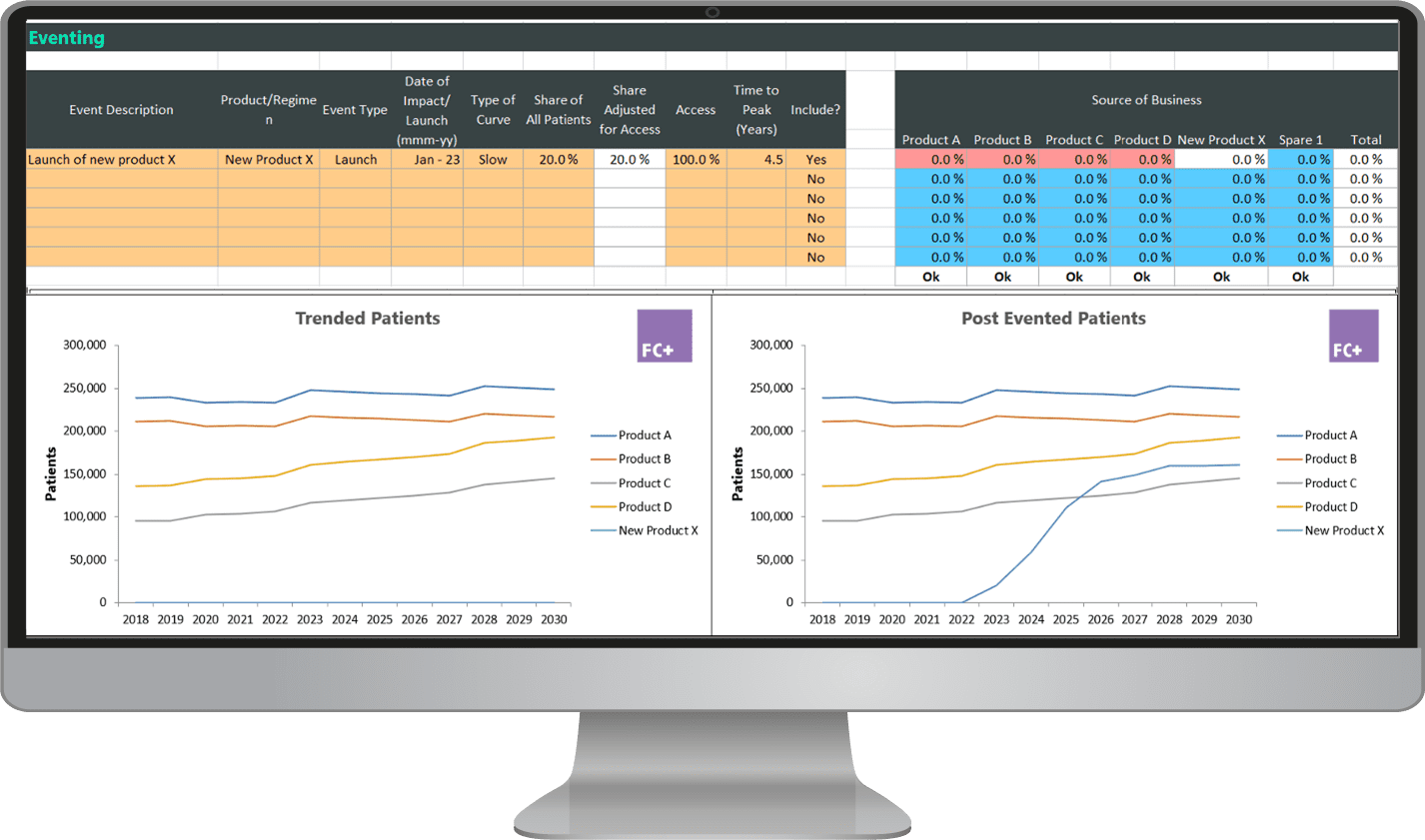

Adjunctive dynamic

The new product will be added onto an existing treatment. The number of treated patients will remain unchanged; however, the treatments per patient will increase. This will not affect the absolute sales of existing products but will impact their share of units and sales in the market. Again, in your market sizing section it will be important to focus on current treated patients. The competitive set in your trending is slightly less important as these will be unaffected (in terms of patient volume) as a result of the new product.

In the screen shot below, you can see that the existing product volumes are unaffected by the new product launch (the source of business is set to 0% for all inline products), as the product is being prescribed on top of the existing treatments.

Market expansion dynamic

The new product may capture patients that are not currently treated and therefore grow the market size of treated patients. As a result, in your market sizing section it will be important to include both current treated patients AND the currently untreated patient pool. In your trending section, a simple way to model this dynamic is to add ‘untreated patients’ into the list alongside the existing competitors.

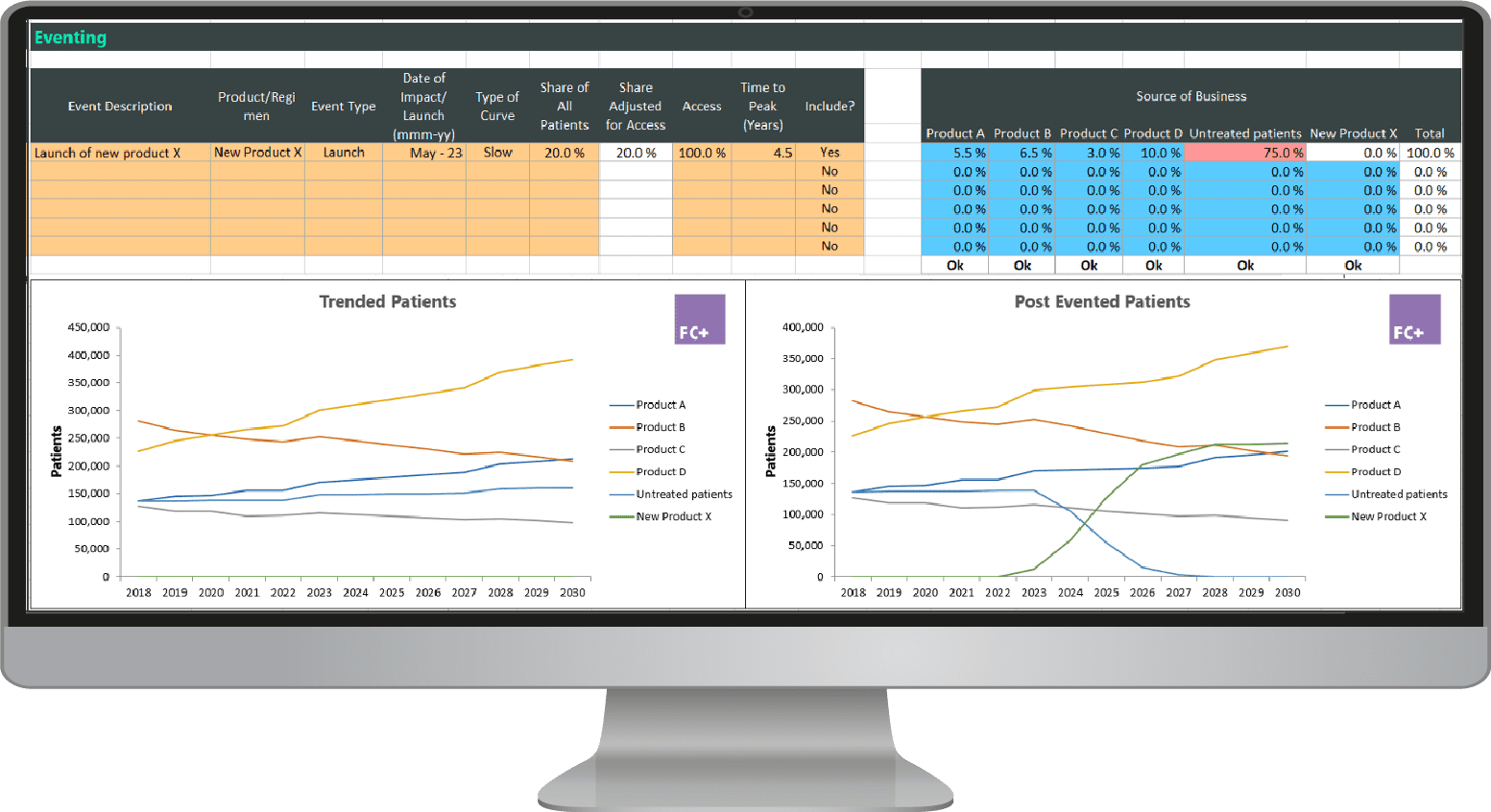

In the screen shot below, we have included ‘untreated patients’ as part of the total market that we are forecasting. As we launch the new product, the majority of its share is coming from the ‘untreated’ population (again controlled via the source of business) and therefore expanding the treated market.

By defining the potential source of business, you create a more realistic forecast which helps to articulate your forecast assumptions in a more transparent fashion. As you can see from the above examples, the source of business can help you model a variety of circumstances (which can often end up being a blend of more than one of the above dynamics).

In conclusion, you can see that forecasting a first-in-class product may require some additional thought but from a methodology and assumption input perspective it really isn’t too different than any other forecast.

CO-AUTHORS:

Kris Barker, expertise in both forecasting and quantitative and qualitative market research projects across multiple therapy areas, gained over the last 15 years.

David James, founder of J+D Forecasting. A respected expert in the field of pharmaceutical forecasting, provisioning training and consultancy to solve global forecasting challenges.

J+D’s FC+ forecasting software gives you access to all the tools and functionality to model first-in-class treatments and at the same time ensures your models follow best-practice forecasting principles.

Not already an FC+ user? Arrange a short demonstration with one of our experts at a time to suit you.