Global pharmaceutical forecasting experts J+D Forecasting have identified some of the key considerations when building a pharmaceutical forecast in the current environment.

Pandemic management – Allow for country differences.

There have been over 117.5 million cases worldwide and over 2.6 million deaths reported. (1)

Country cases have peaked at different times and when subsequent waves happen; this demographic phasing is likely to continue. Government infection management strategies and the implementation of lockdown restrictions continue to vary by country and even individual states.

Follow a Stepwise Approach.

The impact of Covid-19 varies by country, indication and drug classes within indications and individual products. Despite variations, a similar, standard stepwise forecasting approach should be followed. Best practice principles still apply; the forecaster should begin the process by defining the disease and in turn quantify the disease structure.

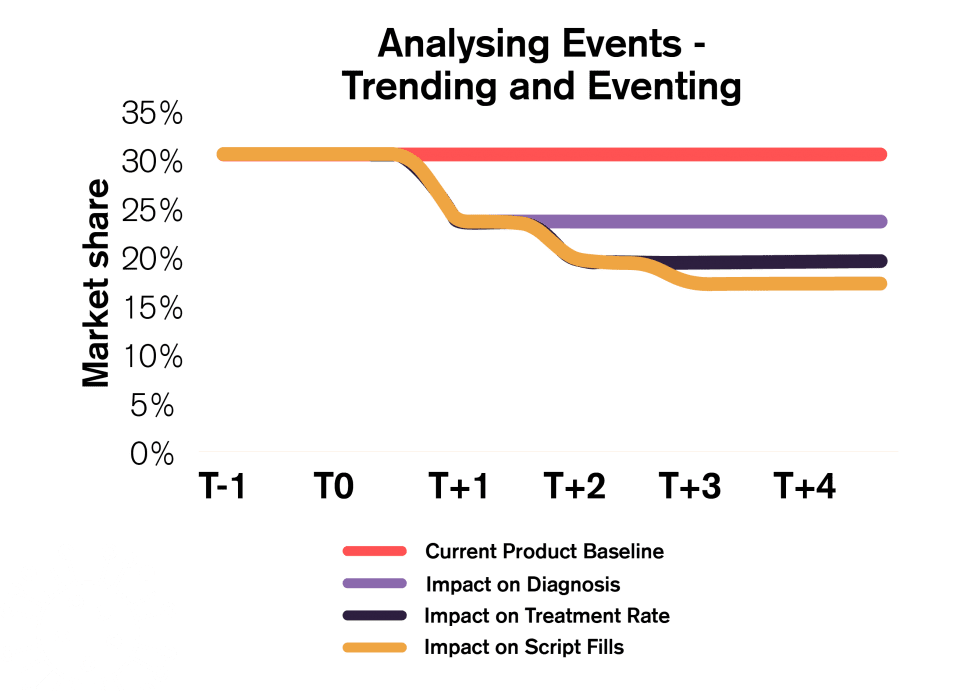

Define. Trend. event

When evaluating the impact of Covid-19 on your chosen market during the first wave the most accurate and up-to-date information is likely to be product sales data. Analysis of this data will provide invaluable insight about the net loss caused by Covid-19. This will help you:

- Understand how the total competitive landscape was affected

Identify if some products suffered greater losses than others - For many markets there is directly applicable data available from the first wave. However, modelling the size and impact of future waves will still be very challenging.

Looking at countries or regions that are entering a second + wave will be a useful guide. It will then be necessary to factor in Government response and state of preparedness to help determine the size and duration of future impacts on your business.

For markets that have not been through the first wave of peak of infection, an analogue market (or markets) will provide a useful guide to the size of the impact and the duration of time they will last. Understandably, the effects are likely to vary greatly depending on disease or therapy.

Considerations.

- Consider markets that are similar demographically and that applied similar disease control strategies.

- Consider sub analogues for large and diverse states or regions in places like the US or Russia.

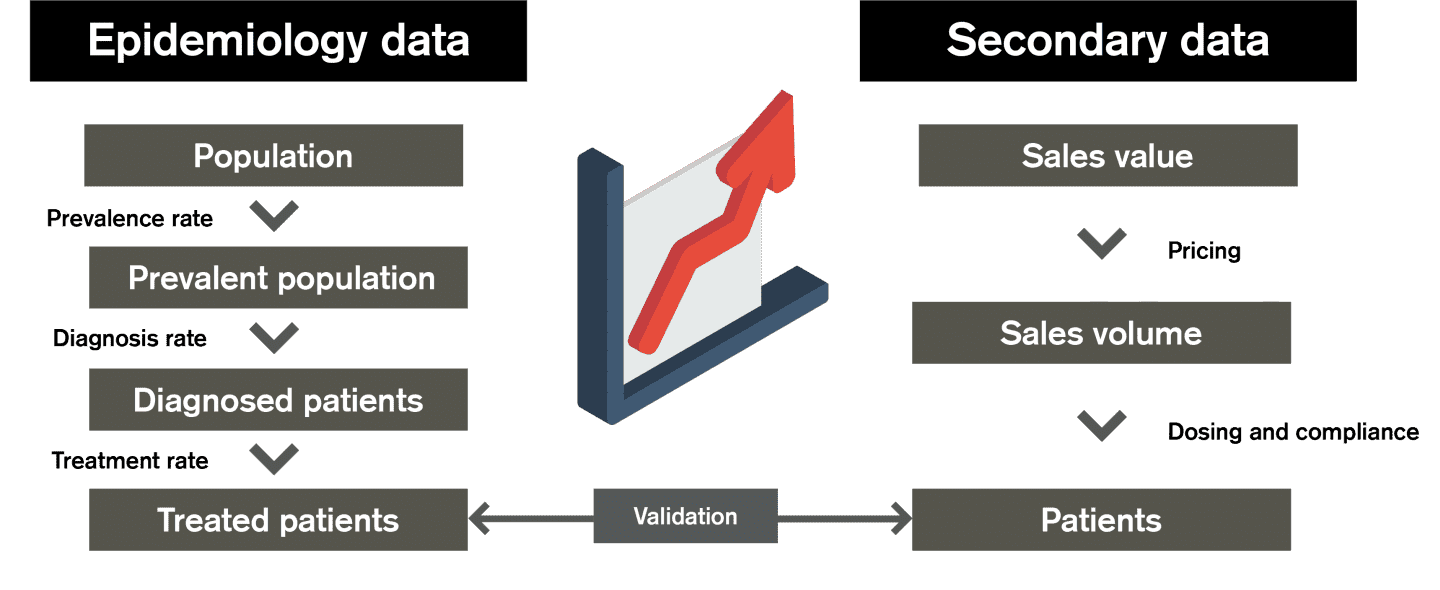

- Secondary sales data provides information in determining how Covid-19 has impacted your business, although it will not provide insight into the points in the patient pathways where Covid-19 may have had a direct impact. Invest the time and resource to develop a patient/epidemiological based model. This will help identify and quantify the variables/segments that could have been directly impacted and thus causing changes in sales.

- Once the patient model is established validate it against the overall sales data.

- A useful exercise here is to model your market from a point just before Covid-19 began to have an effect, create a trend assuming no Covid-19 impact and then overlay your actual data. The delta will be a good indication of the size, duration and uptake of the impact Covid-19 had on sales.

- The next step is to model this delta by applying Covid-19 specific events on key variables within the patient cascade. This exercise will provide a good guide to how future waves will impact your market.

Access to care – Allow for changes in patient populations.

Over 80% of GPs report declines in patient volumes, with more than half describing the declines as significant. Patient reports are similar: 40% of surveyed patients reported having a doctor cancel an appointment, whilst an additional 30% or so cancelled the appointment themselves. (2)

When examining patient visits by speciality, there is a difference, too. For example, -31% weekly patient visits for Cardiology visits, –43% for Dermatology, and -14% in Oncology. (2)

Whilst these figures show a more positive picture for Oncology, a survey carried out by the WHO stated that of 155 countries surveyed 42% stated that cancer diagnostics and treatment was delayed and, in the UK alone, around two million screenings were missed.(3,4) This will inevitably lead to a poor prognosis.

Overall figures across non-communicable diseases are likely to increase even further in low and middle-income countries where health care systems were already stretched prior to Covid-19.

Consider diagnosis and treatment rates.

Earlier, we advised a patient-based model should be set up as a first point of action.

Now, consider how the reduction in access to care should be modelled:

Diagnosis and Treatment rates:

- Diagnosis rates of most diseases will have dropped off significantly during Covid-19 lock down.

- Even post lockdown patients may be reluctant to visit hospitals or practitioners, particularly at-risk patients with Oncological diseases.

Considerations.

- The number of diagnosed patients should be reduced in your forecast to reflect this trend.

- Despite a ‘bounce back’, or even an increase in the diagnosis rate baseline as the initial lockdown eases, be sure to take the individual disease into account. Do not make blanket assumptions.

- For some life-threatening conditions or progressive diseases, the implications of late diagnosis could be severe. If you are modelling a disease by line of therapy and stage of disease this will need to be reflected in an increase in later stage patients or even mortality rates.

- Do not make the mistake of double counting; i.e. the treatment rate of diagnosed patients may stay the same, but the absolute number decline due to lower diagnosis.

- For indications such as Oncology, it will be necessary to develop a Patient-Flow model to accurately assess the future impact of delayed diagnosis or postponed surgical interventions.

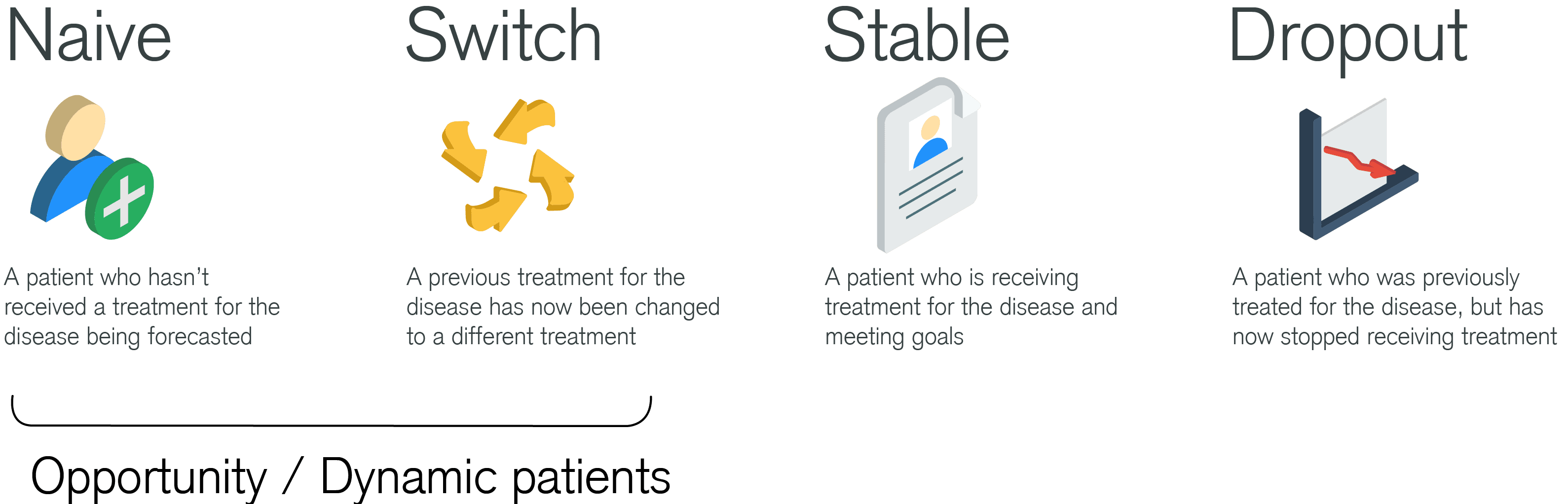

Consider Patient Starts and Switches:

- A drop in diagnosis will reduce the number of new patients beginning treatment.

-

Without consultations, HCP’s will not be able to switch patients that are no longer reaching goal on the current treatment.

Considerations.

- New start and switch patients are often defined as ‘Patient Opportunities.’ A reduction in these opportunities will likely have a greater negative impact on high growth products and promote a steady state in shares.

- The disease profile is key to the size of impact. Acute diseases are ‘by definition’ driven by new patients and will be severely impacted.

- To accurately model this impact, an Opportunity model should be developed. However, for many markets the net gain/loss at the total patient level is likely to provide an acceptable forecast.

Opportunity based forecasting uses distinct groups of patients

Forecasting an uncertain future – be transparent:

It is clear that, at least in the short term, the future remains uncertain. This uncertainty reduces the more we learn about Covid-19 and its effects on the Pharmaceutical market. Nonetheless, we are still very much in unchartered waters. As forecasters, we must reflect and communicate how this uncertainty translates into our forecasts.

How to forecast variability.

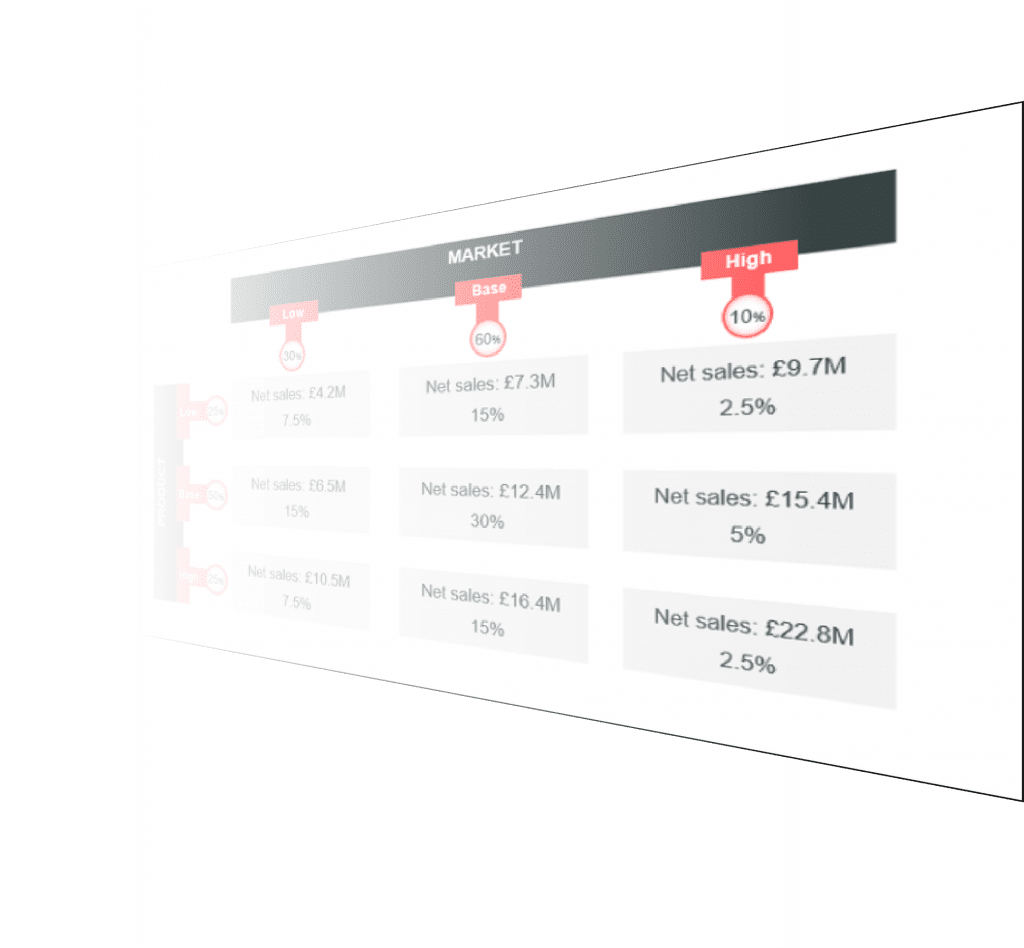

Scenario based forecasting:

A key benefit of the trending and eventing approach is that it makes changing key variables to reflect the level of uncertainty both simple and transparent. Normal practice for scenario analysis is to create a most likely forecast and then an upside and downside to reflect the upper and lower ranges of possible outcomes. However, it might be more accurate and transparent in the case of Covid-19 to follow a 9-box methodology to reflect both macro and micro variability.

Probability-based forecasts using Monte Carlo:

Another useful approach to reflecting uncertainty is to generate a probability based forecast using Monte Carlo. This allows the forecaster to apply upper and lower ranges around key variables and then run many iterations (scenarios) based on distribution curves to identify the most likely outcomes.

Do you need assistance with pharmaceutical forecasting right now?

It is clear that, at least in the short term, the future remains uncertain. This uncertainty reduces the more we learn about Covid-19 and its effects on the Pharmaceutical market. Nonetheless, we are still very much in unchartered waters. As forecasters, we must reflect and communicate how this uncertainty translates into our forecasts.

Thank you in advance for your message. We ask for your details so that we can respond to your query quickly and accurately.

Please click here to view our personal data protection policies.

(1) John Hopkins University, The Guardian, 28.07.20) https://www.theguardian.com/world/2020/jul/28/coronavirus-world-map-which-countries-have-the-most-covid-19-cases-and-deaths

(2) https://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/covid-19-and-commercial-pharma-navigating-an-uneven-recovery

(3) https://www.who.int/news-room/detail/01-06-2020-covid-19-significantly-impacts-health-services-for-noncommunicable-diseases

(4) https://www.bbc.co.uk/news/health-52876999

(5) The Impact of the COVID-19 Pandemic on Global Pharmaceutical Growth, IQVIA 2020

(6) https://www.ecdc.europa.eu/en/geographical-distribution-2019-ncov-cases

Figures from https://www.worldometers.info/coronavirus/

A McKinsey report (published April 2020) states that over 80% of GPs report declines in patient volumes, with more than half describing the declines as significant. Patient reports were similar: 40% of surveyed patients reported having a doctor cancel an appointment, whilst an additional 30% or so cancelled the appointment themselves. (2)

When examining patient visits by speciality, there was a difference, too. For example, -31% weekly patient visits for Cardiology visits, – 43% for Dermatology, and -14% in Oncology. (2)

Whilst these figures show a more positive picture for Oncology, a survey carried out by the WHO (published June 2020) stated that of 155 countries surveyed, 42% stated that cancer diagnostics and treatment was delayed and, in the UK alone, around two million screenings were missed.(3,4) This will inevitably lead to a poor prognosis. Overall figures across non-communicable diseases are likely to increase even further in low and middle-income countries where health care systems were already stretched prior to Covid-19.