What is loss of exclusivity?

When a pharmaceutical company develops a new drug, they are often granted a patent that gives them exclusive rights to manufacture and sell the drug for a certain period of time. This period is typically around 20 years, during which the company can charge a premium price for the drug in order to recoup the costs of research and development.

However, when the patent expires, other companies are free to produce and sell generic versions of the drug. This is known as loss of exclusivity (LoE), and it can have a significant impact on the original company’s bottom line.

Generic drugs are typically much cheaper than their branded counterparts, as the companies producing them do not have to invest as much in research and development or marketing. As a result, when a generic version of a drug hits the market, sales of the original branded drug tend to decline sharply.

This might be a direct threat to your originator brand, or it could be a competitor brand losing patent and the arrival of the generic entrant could have a wider impact on the entire market (not just the branded originator). Either way, it may well be an important consideration and something to build into your forecast structure.

So how do forecasting teams model loss of exclusivity and generics entering the market?

First, it is important in your trending section to make sure you have identified all current and future products of interest, including any generic entrants. This list will then drive the available products to include in your events section.

Modelling this using FC+ from J+D is easy to do – in fact, using the events section of your forecast, you can do this in a very clear and transparent way.

In the example below we have set up our trending section to focus on five of the main on-market brands and then grouped all remaining products into an ‘other’ grouping. This helps to simplify the model and ensures the focus is on those brands of greatest competitive threat. We have also included a future biosimilar and a generic entrant that we can then launch as specific future events.

Once the setup of your market is complete within the trending section, you can move onto your events.

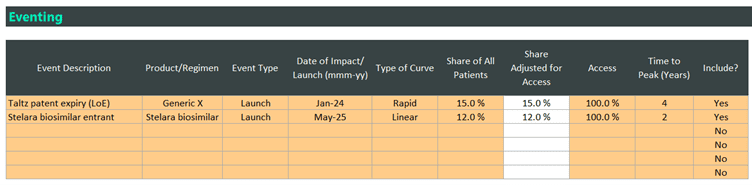

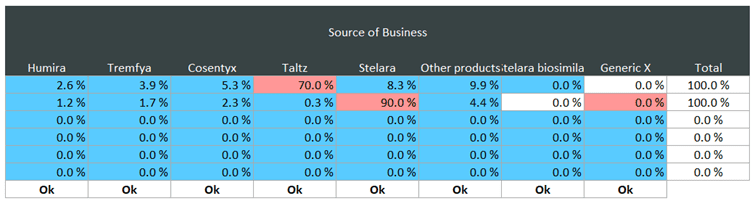

In the example below, you can see that we have a Taltz generic entering the market next year, with a Stelara biosimilar the year after. These have slightly different peak shares, speed of uptake and uptake curves. But in the source of business section, this is often quite specific for biosimilar and generic entrants. In the first event, where we are modelling a fictitious LoE for Taltz, you can see that the source of this business for the generic entrant is mostly coming from the originator brand (Taltz).

A similar situation can be seen for the Stelara biosimilar. Via the Source of Business section, you can determine the impact the generic entrant will have on the originator brand and also the wider market.

Despite the challenges the loss of exclusivity and entry of generics brings, by modelling in this way your forecast is clearly telling the story of the impact that the generic entrant is expected to have. Therefore, the resulting outputs are less likely to be questioned – assuming stakeholders agree with your assumptions, of course.

In conclusion, the loss of exclusivity and entry of generics is an inevitable part of the pharmaceutical industry. While it can be a difficult time for companies, it ultimately benefits patients by increasing access to affordable medication which can have a significant impact on public health. No matter which LoE strategy a company chooses to pursue, planning should commence two years prior to the anticipated loss of exclusivity date to allow the organisation time to develop and deploy their strategy.

This can be a challenging time for pharmaceutical companies, as they must find new ways to differentiate their product or face a significant drop in revenue. Some companies may choose to focus on developing new drugs, while others may invest in marketing campaigns to try to maintain their market share. Forecasting teams should be mindful that strategies can and should evolve over time to address changing business priorities and market conditions, so be ready to adapt to unplanned changes in the generics landscape.

AUTHOR:

Kris Barker, Senior Implementation Director at J+D Forecasting. Expertise in both forecasting and quantitative and qualitative market research projects across multiple therapy areas, gained over the last 15 years.

Speak with an expert.